At Union Bank, we have tailored solutions designed to help grow SME business. These include easy access to finance for working capital, dedicated relationship manager, capacity building for businesses, access to markets and a conducive banking climate for investment.

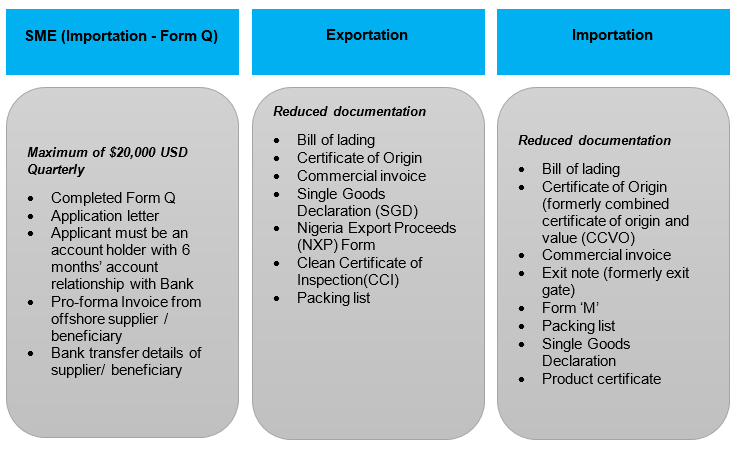

SME customers now have access to foreign exchange easily in any Union Bank branch to purchase eligible imports. SMEs can access up to US$20,000 per quarter for importation without opening Letters of Credit or Bills for Collection under the Form Q scheme.

New policies simplifying import and export transaction documentation in Nigeria have also been introduced

See table below

SME Offerings within UBN

SME Offerings within UBN

- Union Bank SME Hub – an e-commerce channel that addresses and solves distribution and marketing challenges for SMEs; by providing an online presence, with significant cost advantage compared to other online markets and fast transaction settlements.

- Union Bank Business Debit Card – it provides transactional ease and security and also gives business owners the opportunity to enjoy discount with designated Union Bank partners

- Union Bank Loans – we offer secured and unsecured loans for small businesses; typically trading without any form of registration